Disclaimer: Views, opinions and analysis provided by guest speakers and participants are their own. Reproducing them on our website does not imply that they are endorsed by Neyen.

ERPAs: An Introduction

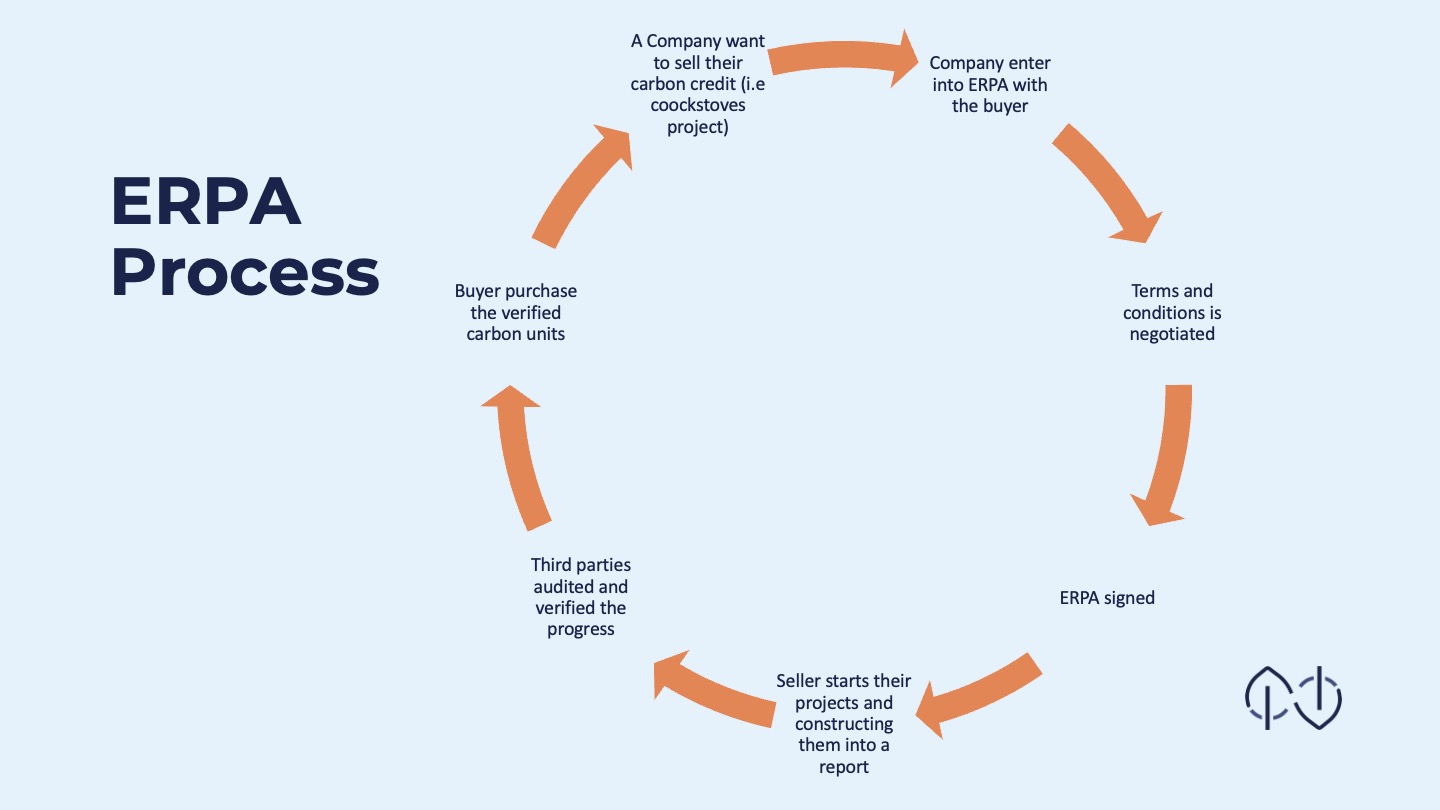

Neyen’s consultant, Sarfina Adani, started the workshop by providing a scene-setting presentation on the basic introduction of Emission Reductions Purchase Agreements or ERPAs. ERPAs allow a Party to deliver verified emissions reductions to another Party (or ITMOs for MOPAs). ERPAs are legally binding agreements between parties that identify responsibilities, rights, and obligations to manage project risks, and commercial terms including price, volume, and delivery schedule of credits. The level of financial commitment implied by an ERPA can leverage its attractiveness and can boost investor confidence. Therefore, involved Parties take immense care in the negotiation process – which can often be time-consuming and complicated.

ERPAs contain several key elements, which may include:

- Scope of Agreement

- Quantity and price of emissions reductions to be delivered

- Delivery and payment schedule of emissions reductions

- Consequences of non-delivery for the seller (e.g., penalties or compensation)

- Obligations for buyers and sellers

- Representations and warranties

- Change in law

- Liabilities and indemnities

- Dispute resolution

- Termination

Impact of Indonesia’s Regulatory Framework on ERPAs Structuring

Indonesia has signed an ERPA with the Forest Carbon Partnership Facility (FCPF), committing to a reduction of 22 MtCO2e for the period of 2021-2025, in exchange for USD 110 million, through the East Kalimantan Jurisdictional Emission Reductions Program with an area of 12.7 million ha.

Guest speakers from UMBRA Law Firm explained that the enactment of PR 98/2021 and MOEF 21/2022 as key regulations of Indonesia’s carbon trading have impacted some considerations in the process of structuring ERPAs. For example, business entities that engaged in carbon trading or results-based payments before the enactment of PR 98/2021 were required to comply with the provisions regarding the implementation of the Carbon Economic Value (NEK) no later than 2023. However, transactions conducted after the enactment of the regulation will be subject to an additional obligation in the form of benefit-sharing payments based on the carbon transaction value.

The regulations also require ERPAs to outline the “buffer-reserve” mechanism towards authorized carbon units or SPE-GRK for domestic purposes. In addition, any changes towards ownership of carbon units must be registered and reported in the SRN-PPI as administered by Indonesia’s Ministry of Environment and Forestry.

Possible Adjustments/Amendments to the Regulations

In the Q&A session, participants asked for clarity on several elements for consideration before starting negotiations with potential buyers. One question was raised on the recognition of international Validation and Verification Bodies (VVBs) in Indonesia to allow the use of more advanced methodologies as opposed to the ones registered in the SRN-PPI. As of now, MOEF 21/2022 states that VVBs are required to meet the government requirements, including accreditation by the National Accreditation Committee (KAN), to be eligible to conduct verification and validation processes for mitigation activities in Indonesia.

Other questions were raised on the clarity of conducting international carbon trading activities, especially considering the prioritization of NDC achievement by the government. To these questions, speakers responded that there are potential adjustments and amendments being made towards existing regulations in enhancing Indonesia’s participation in the international carbon markets, which participants should look forward to.