Disclaimer: Views, opinions and analysis provided by guest speakers and participants are their own. Reproducing them on our website does not imply that they are endorsed by Neyen.

Overview of the International Carbon Market

Guest Speaker, Björn Fondén (International Policy Advisor at IETA) opened the workshop with a brief overview and update on the international carbon market. A carbon market is a way to incentivize emission reductions by giving them a price or value, recognizing that there is a need to increase annual climate finance by more than 590% (including public, private, and international sources) to reach Paris goals. In this regard, Article 6 mechanisms can help to raise global climate ambition. A study by IETA and University of Maryland found that Article 6 can help to save as much as $250 billion and reduce 5 GtCO2e per year a year by 2030 if such savings are invested in additional mitigation activities.

There are different types of carbon market instruments, including compliance emission trading systems (ETS), voluntary carbon markets (VCM), and international carbon markets under Article 6 mechanisms. However, it is worth noting that the voluntary carbon markets are still small compared to other carbon pricing instruments, with ETSs and carbon taxes valued at about 50 and 22 times larger in revenue compared to VCM, respectively.

Ensuring Integrity in Carbon Markets

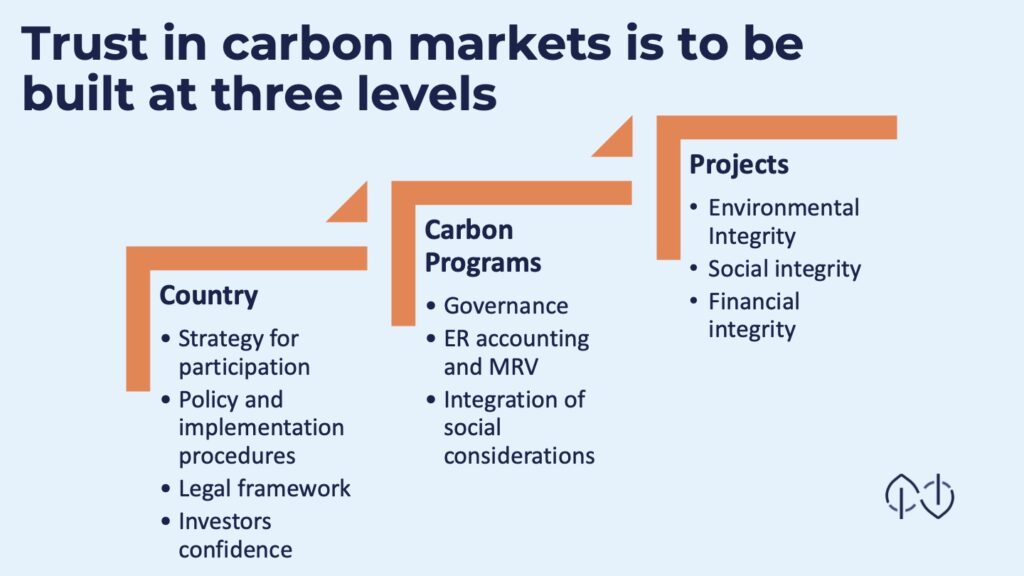

Miguel Rescalvo, Neyen’s Managing Partner, explained that it is important to emphasize the integrity of the carbon markets. Several initiatives such as the Integrity Council for the Voluntary Carbon Market (supply-side) and Voluntary Carbon Market Initiative (demand-side) have provided guidance in ensuring integrity in the voluntary carbon market. In ensuring integrity, trust is an important element in carbon markets, and it is built at three levels: country level, carbon program level, and carbon project level.

Integrity must be ensured in three ways:

- Environmental integrity

- Social integrity

- Financial integrity

Environmental integrity is ensured through no increase of global aggregate emissions by underlining the additionality principle and robust accounting, and verification & validation methodologies. Social integrity can be ensured by sound safeguarding mechanisms, stakeholder involvement, and benefit-sharing. Financial integrity can be ensured by a long-term sustainable business model and continuous support to communities.

Ensuring Integrity and Effectiveness of Carbon Market in Indonesia

Ryan Permana (Energy Auditor Validator at TüV Rheinland) and Handoko Limaho (CEO at Hutan Kencana Group) also shared perspectives from Verification and Validation Bodies (VVB) and project developers on enhancing integrity in Indonesia’s carbon markets. respectively. To conclude, with a robust framework and approach, Indonesia has the potential to be a key player of carbon markets in the region and even worldwide. In realizing this, IETA provides several practical considerations for Indonesia in creating an effective carbon market ecosystem.

- Communicate a clearly defined NDC implementation roadmap with a holistic carbon market framework, including how Article 6, the ETS and VCM will support strengthened climate ambition.

- Clarify next steps for expanding the compliance ETS coverage, target stringency and offset eligibility.

- Ensure well-functioning, trustworthy and transparent infrastructure, including registry and exchange.

- Promote accessibility for foreign participants in the market including by alignment with international standards, best practice quality and integrity criteria, to help channel finance for conservation and low-carbon development.

- Facilitate linkages through Article 6 of the Paris Agreement by providing clarity on rules for authorization, sequencing, project types, and reporting.