Transcript:

The Convention and concepts of carbon trade

Climate change policy: No "Love at first sight"

So firstly, we can say that climate change and climate change policy from the start, maybe it was not love at first site. The ultimate objective of the UNFCCC is to keep the temperature rise to a limit that is not dangerous to humans and to life on earth.

This framework convention was adopted in 1992, and it entered into force in 1994. It does not mention the concept of carbon market mechanisms or carbon markets or carbon trading at all.The UNFCCC, (the Climate Convention) does not specifically mention the concepts of carbon markets or carbon mechanisms or carbon trading at all. What it does is that it says that countries can implement policies and measures jointly…to the achievement of the objective of the convention.

First Emissions Trading Schemes

During the 1980s, emissions trading was introduced in the US and they started to have trading under the acid rain program, then aiming to reduce sulfur dioxide emissions. So around 1989, the concept started to become introduced into this context of reducing greenhouse gas emissions. There was a push from the United States and OECD in the nineties, and they tried to introduce the concept into the UNFCCC, but this was not successful at this time.

First attempts to have a carbon crediting mechanism

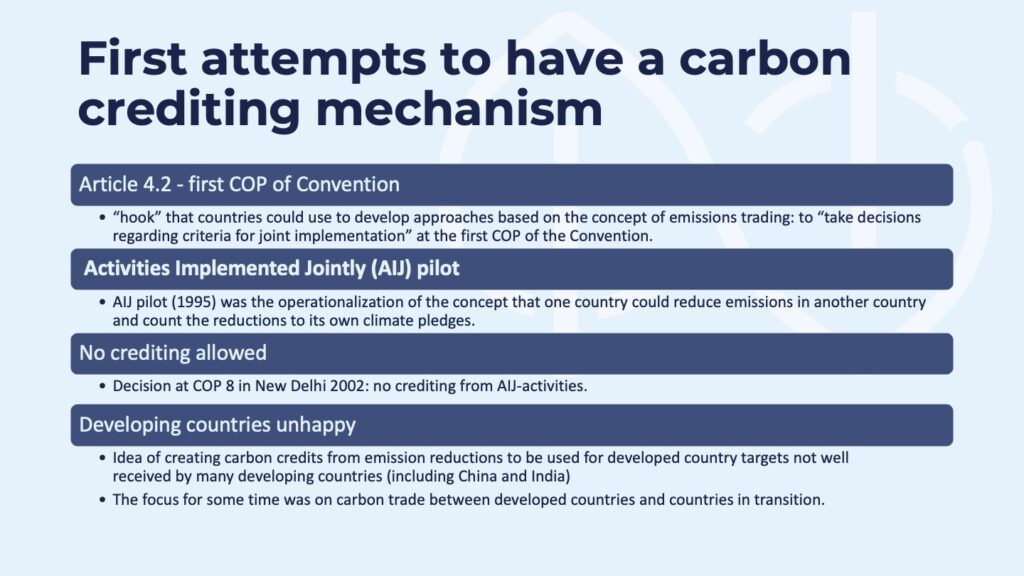

The idea that countries could do things jointly was sort of a hook that countries could use to develop approaches based on the concept of emissions trading. One of the decisions, which was at the first meeting of the parties of the convention was to take decisions regarding criteria for joint implementation. So that refers to this, that countries could collaborate to do things together. This resulted in something that was called a pilot phase for activities implemented jointly. This started in 1995.

So this was based on the concept then that one con country could reduce emissions in another country and count those reductions towards its own climate pledges. At this time, though, it was clear that the activities implemented jointly should not lead to any carbon crediting. So that meant that the emission reductions resulting under that program, under that framework, could not be used for meeting the Kyoto Protocol targets later on. But this was, anyway, the start of the idea that you reduce emission somewhere else, and you can count it towards your own target.

The developing countries were not very fond of this idea at the beginning. Especially large countries with emissions like China and also other large countries such as India with very low per capita emissions. So in the beginning, the focus on this carbon trade was mainly between developed countries and countries in transition, transitioning to a more Western style economy and democracy.

Kyoto Protocol: Emissions trading

Somehow emissions trading emerged as a key part of the Kyoto protocol. This is, of course, due to continuous push by the US and the OECD. The EU was quite skeptical in the beginning about this, but also came to see that this was maybe something that is good to have and maybe something that is necessary if developed countries were to sign and agree on commitments and quantitative targets for a commitment period.

So the Kyoto protocol was signed in 1997. The rule book was finalized in 2001, where it also was defined that there would be a first commitment period from 2008 to 2012. For this initial commitment period, there were 36 developed countries that agreed to reduce their emissions by an average of 5% per year during the commitment period compared to a 1990 base year.

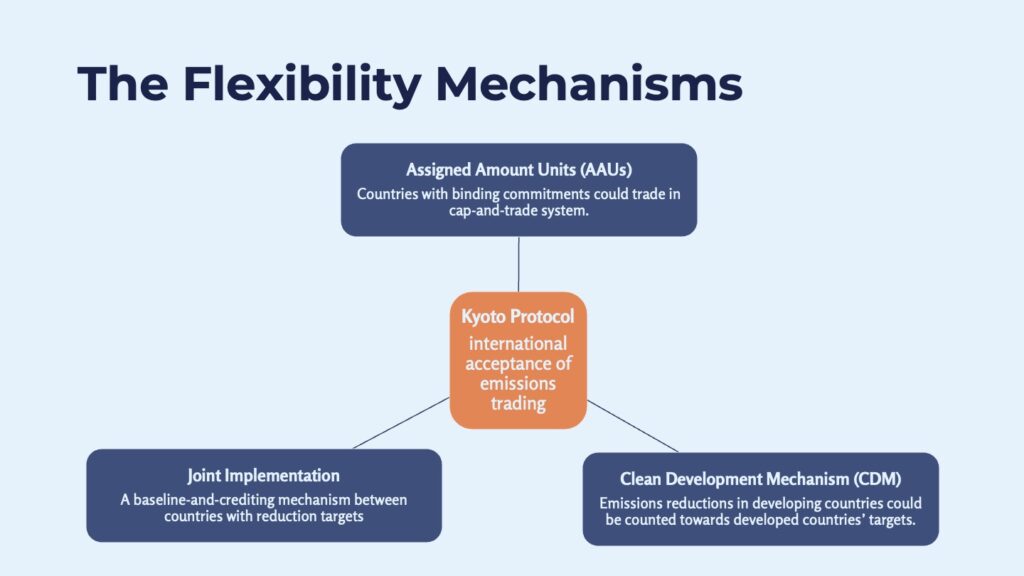

In the Kyoto Protocol there were two types of market-based mechanisms introduced. It was both creating and crediting, and these were called flexibility mechanisms, or flexible mechanisms. Since this provided the flexibility for country to achieve their quantitative emission reduction targets by making emission reductions in another country.

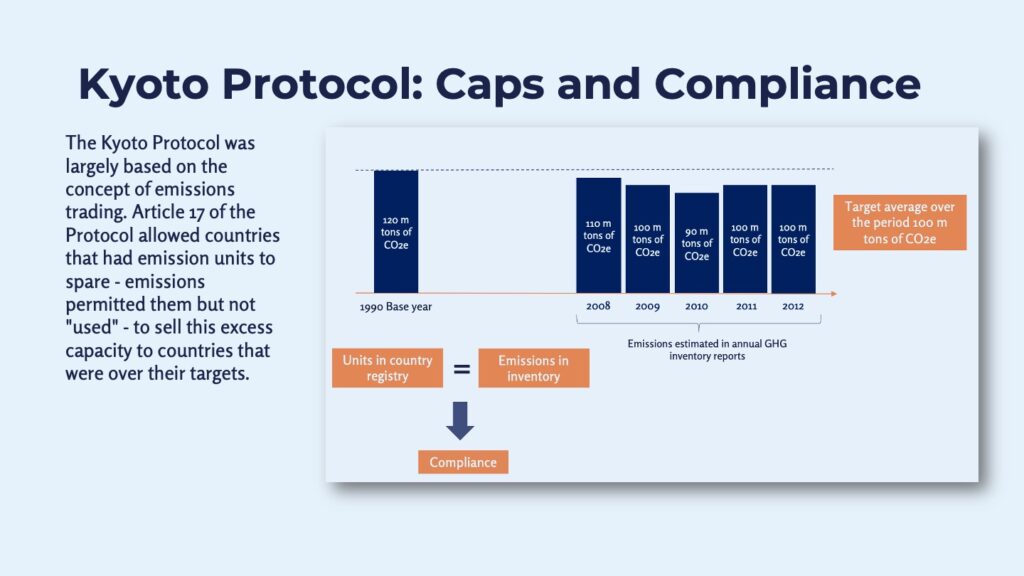

Kyoto Protocol: Caps and compliance

The Kyoto Protocol was very much based on an emissions trading concept. Again looking at the way that the convention was created and the initial resistance against emissions trading, it could have been a bit surprising. But I think one of the key reasons for it to develop was that it was probably the only way to get developed countries to take on quantitative targets.

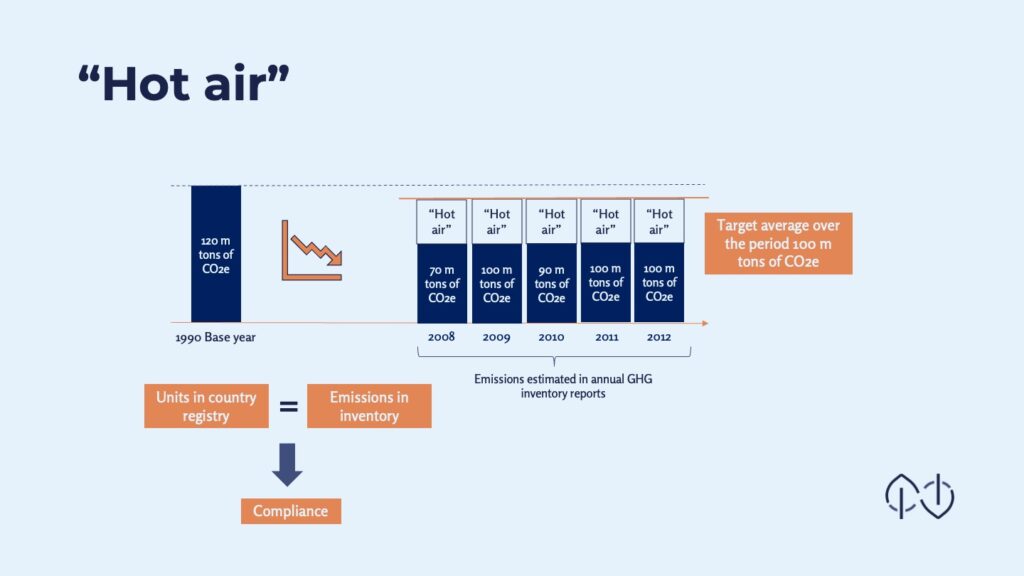

The figure above shows that, for instance, in one country you have a baseline of 120 million tons of carbon dioxide emissions in that year. And the target is an average over five years to reduce to 100 million tons of CO2 per year. And so the cap was created. So if you recall the first session in emissions trading, you set a cap. And the countries here needed to have as many allowances or carbon units in their registry as they had emissions, as per their inventory. So if that was the case, then they were in, in compliance. That means, in this example, you would see that this country will comply with the target, even though that the first year it has emitted 10 million tons too much, but it has lower emissions in the third year. So on average this is fine. At the end of the period this country is more or less zero in its compliance. So this is basically a cap-and-trade system for the developed countries with caps, with targets.

The Flexibility Mechanisms

The Kyoto Protocol meant the introduction of, and international acceptance of emissions trading. As you saw in the former figure, countries with binding commitments were able to trade their allowances. Under the Kyoto protocol these are called Assigned Amount Units. There was also a flexibility mechanism introduced that was outside this group of developed countries with targets. This was the Clean Development Mechanism, and this made it possible to also reduce emissions in developing countries and not only in developed countries.

The Kyoto Protocol had what some people call a firewall. There was a clear division between developed countries and developing countries as to their targets and commitments. Only developed countries had quantitative targets and developing countries had not. So in this case that meant that developed countries could purchase carbon credits from developing countries. They could use the carbon credits towards their quantitative targets, but the developing countries did not need to or could not, account for these reductions for their own targets simply because at this stage they did not have any such target.

The other thing that was introduced which was more directly based on the activities implemented jointly was the joint implementation. That worked in the same way as CDM, but between developed countries with targets. Both joint implementation and CDM were first based on individual projects. Later on they could also be program based with several activities included in that program. Then there were baseline and crediting mechanisms. Reductions were counted against a baseline.

New concepts

With the introduction of CDM new concepts were introduced. When they discussed joint implementation and doing things in other countries of course you had to have a baseline and you needed to have a methodology for calculating the emission reductions etc. But for CDM there was an additional issue since the emission reductions were generated outside the Kyoto protocol bubble (that means the whole carbon budget that was created if you aggregate the targets for the developed countries). So if you imported these Certified Emission Reductions (CERs) from CDM, these would add to the bubble and sort of expand the bubble so the developed countries actually could emit more. So this created a concern that actually the emissions would just increase.

Additionality and Certified Emissions Reductions (CERs)

By introducing additionality, the parties to the convention thought up a way of reducing that risk by ensuring that only credits from projects that wouldn’t have happened otherwise without financial support, without the selling of CERs, were implemented. This is a concept that has been part of the discussions for baseline and crediting mechanisms ever since. But it came from (just to bring this part of history) this idea where you started to add these CERs to the Kyoto bubble and needed to be sure that these were not reductions that would’ve happened anyway.

Independent verifiers

The emergence of CDM and JI also created a demand for independent verifiers. So this created, and I wouldn’t say industry, but something like that, of firms, of companies that could validate the methodology and project design documents and also verify the emission reductions. So around this CDM, there was an industry of consultants and independent verifier companies etc.

Removals: An issue since the early days

One thing that is hot today in discussions is removals, and this is a bit of a sidetrack, but you see this in the discussions about how the supervisory body of the new article 6.4 mechanism is managing removals and what they have proposed. But just to mention the main issue the CDM had two main project types: reforestation and afforestation, and these are then typical removals projects. You plant forests on land that has been converted or land that has been deteriorated, or that previously has not contained forests at all.

The issue of permanence came up also during this period. And this resulted in that the certified emission reductions could be of two types, and these were T-CERs (temporary CERs) and long-term CERs (L-CERs). The idea here was that if the removal does not continue to be a removal, then the T-CERs need to be replaced by any other unit, any other CER or a new T-CER. I’m just mentioning this because you’ll see in the discussions today. How do you deal with removals and permanence when you talk about baseline accrediting mechanisms. These T-CER and L-CER projects did not become a success. I think the CDM resulted in something like 9,000 projects, and I think 100 or so became removal projects and a lot of them were developed by donors such as the World Bank. So this is just to highlight that removals and forestry were an issue already. Forestry (reforestation/ afforestation) were adopted in 2009.

The Kyoto Protocol did not deliver

The Kyoto protocol had the first commitment period in 2008 to 2012. The target for the developed countries was 5%, but in reality it delivered above that or below that…depending on how you see it. So this seems like to be something very positive, but global emissions did not decrease and a large part of this reduction could be explained by a generous allocation to former Soviet countries. The reason for this was that 1990 was used as a base year for all countries. In 1990, many countries that were then part of the Soviet Union had a peak in economic activity, and accordingly, they also had peak emissions. Following the collapse of the Soviet Union in 1991, all these countries started the restructuring of their economies, a shift away from heavy industry, et cetera. This then created emission reductions that came about by no additional, no new action by these governments.

This created a surplus of allowances, of assigned amount units, and came to be called Hot Air. I wanted to bring this up also because you will see, if you haven’t already seen that, there are discussions about Hot Air also in the discussions about NDCs and in relation to how business-as-usual scenarios are set. More concretely, we can show what this meant.

Hot air

If we take another country, but have the same emissions at the base year 1990, and then you see (which the small arrow shows in the diagram) that the economy went down quite heavily. This meant that (for this five year period) this country had significantly lower emissions than the base year and even significantly lower than the target that was set. So this created a lot of emissions, millions of emission reductions that was called Hot Air because it came about only because of this, let’s say the collapse or restructuring of their economies.

The Kyoto Protocol fade out and CDM market crash

This led to, of course, criticism of the Kyoto Protocol and the environmental integrity and discussions that, yeah, what we actually did here was not enough. At the same time there were other things that threatened the Kyoto Protocol, jumping here to the third bullet – When the discussions for the second commitment period started, it was clear that some countries were going to withdraw from the protocol. Japan, which was a surprise given that the Kyoto has given the name to the Kyoto Protocol. Before this happened I remember diplomats saying, uh well Japan will never leave the Kyoto Protocol because it was signed in Kyoto, but they were wrong. Other countries such as Russia, Canada and United States also left the Kyoto Protocol. Canada came back at some point but in essence, this meant that the large emitters had left the protocol.

The other thing that is important from this Kyoto Protocol period was that the EU-ETS, which started in 2005, had become the largest emissions trading market by 2008. The EU that initially was a bit hesitant towards emissions trading adopted the idea and was able implement it on a regional scale in the EU.

During the first commitment period from 2008 to 2012, the EU ETS allowed CDM credits to be used in that system. This created quite a substantial business. You could have prices up to 25 euros per ton of carbon dioxide. You could even get a high price for CDM credits. But after 2012 the EU decided to cease CDMs and the market shrank quite considerable considerably. By 2012 the price for CDM credits, for CERs, were down to around 0.5€ per ton of carbon dioxide. So this is what you can call a CDM market crash and we’ll come back to what the implications of this were.

Negotiations for a New Regime

Eyeing a New Regime (Post-Kyoto)

So that sets the scene for the negotiations for a new regime. We had a Kyoto Protocol that over delivered due to Hot Air, large countries, developed countries starting to leave the Kyoto Protocol and the CDM market, which had been prosperous for companies, but also gained a lot of traction in developing countries had crashed.

There were also other issues with the CDM. For instance, for a time it was called the China Development Mechanism because so many projects were developed in China and not in Zambia, for instance. And that was another problem that was discussed.

So these discussions for new regime actually already started before the second commitment period of the Kyoto protocol around 2007 and started to become intense around 2010 to 2012. People could see that the Kyoto Protocol didn’t match the reality. They could see that countries and the private sector were developing compliance carbon markets and Voluntary Carbon Markets. International standards on the voluntary market like Gold Standard, Verra, Plan Vivo emerged and more and more domestic Emissions Trading Schemes, and also the baseline accrediting mechanism.

This meant that it was difficult to have a system with a UNFCCC top-down structure with this negotiation of a cap and then this compliance system. So Parties, countries, started to think that maybe this is more about multilateral cooperation in the bottom-up way and making sure that these different initiatives could be linked and interact together. So they thought that a better response to climate change would be guiding and regulating a response or respond to the existing practices in the carbon market and these initiatives that took place outside the Kyoto initiatives.

So this changed things from having a centralized UNFCCC emissions trading scheme. The idea, the framing, started to turn to “let’s just try to coordinate this at the central UNFCCC level”. It is in light of this that we can see the new concepts and frameworks being developed.

The Article 6 determinants

The Article 6 as we see today comes from somewhere obviously, so how did it emerge? Why do we have these three parts of Article 6? Why do we have cooperative approaches? Why do we have a mechanism? Why do we have non-market approaches?

The first thing is that Japan, as you now know, left the Kyoto Protocol and was not part of that from 2013 onwards. They thought that we would need to have a framework where we can have a diversity of mechanisms and approaches and just have principle guidance from the UNFCC, and allow countries to develop this bilaterally, multilaterally or individually. The background here was of course that Japan was developing and starting the Joint Crediting Mechanism in 2013. So they had this plan to do this on a bilateral basis and not through CDM. One of the reasons was that they thought CDM was very bureaucratic and complicated. They also obviously had left the Kyoto Protocol, so there wasn’t any alternative for them to continue to work with the CDM.

The Framework for Various Approaches (FVA)

Japan proposed a framework for various approaches. This was launched in Durban at COP 17, 2011. As you will see, this is the basis for Article 6.2, this is the basis for cooperative approaches: countries deciding themselves very much about anything that has to do with how to implement this.

New Market-based Mechanism (NMM)

The New Market-based Mechanism was proposed by the EU and some other countries were supporting this, I think Korea and maybe Mexico at some point. What they wanted to have was a sectoral mechanism, so not projects based or program based. They wanted to scale it to have this at a sectoral level.

Non-Market Approaches (NMA)

Thirdly, the convention – let’s say it like this; as mentioned not all parties were very enthusiastic about carbon markets in relation to the Climate Change Convention. Bolivia and some other countries had an ideological response to carbon markets from the beginning and all along suggested to have a non-market based approach as a compliment to the market based mechanism. The requirement throughout the negotiations was that the non-market approaches should have the same space and time and attention in negotiations as market-based mechanism. You can imagine the frustration of the negotiators to deal with this situation.

Gloomy outlook for mechanisms in Paris

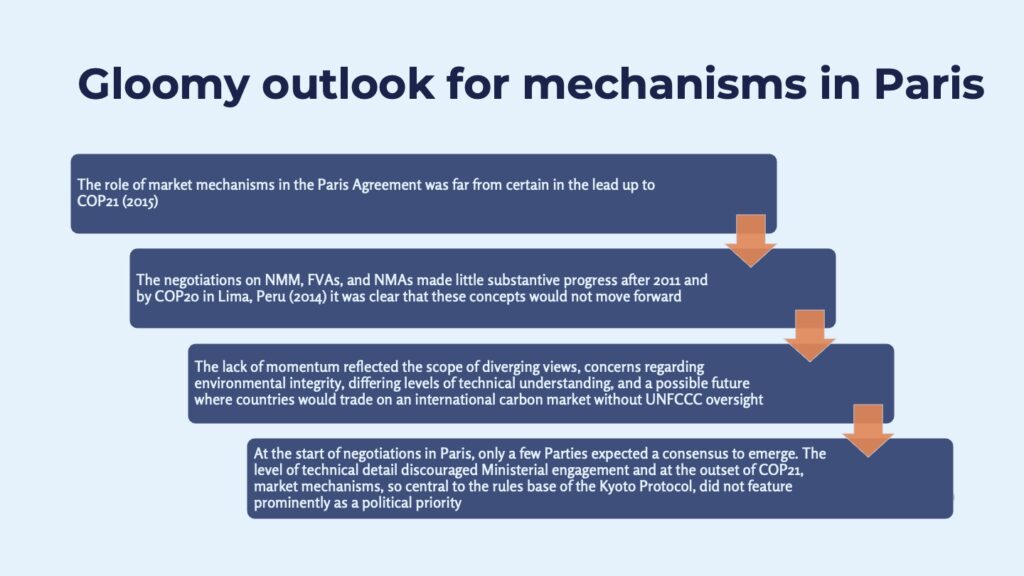

The role of market mechanisms in the Paris Agreement was far from certain in the lead up to COP 21 2015. Why was that? Well, these discussions on the New Market-based Mechanism, the Framework for Various Approaches and the non-market-based approaches had made very little substantive progress since 2011. And at COP 20 in Lima, just the year before Paris, it was clear that the Parties (the countries) were not going to move forward with those concepts.

So when the Paris Agreement negotiations started in 2015, I should say they had been ongoing with a view to reaching an agreement in Paris. But looking back, let’s say to early 2015, there was a lack of momentum. A lot of diverging views, concerns from some parties regarding environmental integrity, different levels of technical understanding, so it was possible to imagine a world where international carbon markets took place without any UNFCCC oversight. So this meant that basically some countries said that we actually don’t need the UNFCCC to have this collaboration between countries, to have international markets, carbon markets, going – we don’t need that.

All in all, not many countries believed a consensus would be reached on New Market-based Mechanisms in Paris. At the technical level markets have always been a bit difficult for ministers to engage with. In addition to this, in Paris – compared to the prominence that carbon trading had in the Kyoto Protocol – well, it didn’t have that at all when the Paris Agreement was discussed.

New Mechanisms (but not that new)

Somehow there was some kind of miracle, parties managed to agree on something yet! You see from this figure where article 6.2, 6.4 and 6.8 come from. The Framework for Various Approaches led to Article 6.2. There was no New market-based Mechanism. There was no sectoral mechanism. Instead you had Article 6.4, which is like a CDM 2.0, also with a feature from JI. The Non-Market Approaches, more or less stayed in the same concept as before.

Article 6 work program

What we see today and for the few last years is that Parties are still working on some of the details. The key things that came out of Paris (apart from these three different articles or avenues) was that the Parties decided on a work program for Article 6, and that a key thing here was that SBSTA which is the technical subsidiary committee under the convention, they got the mandate to develop guidance to ensure that double counting is avoided on the basis of Corresponding Adjustment.

So here comes Corresponding Adjustment! Of course also at this point, it was determined that there should be rules, modalities, and procedures for the new mechanism. So a lot of things that we already mentioned above are included:

- the mitigation, the emission reductions need to be real,

- they have to be additional

- you need to have independent entities that verify and certify the emission reductions, et cetera.

So a lot of stuff coming from the learnings of CDM and JI came into this mechanism.

Key elements of Article 6

Article 6.2 introduced three key things that were new to the convention. You will know this by now, but the key things here are the ITMO the International Transfer Mitigation Outcomes, corresponding adjustments, and the demand to have authorization of ITMOs. So that is what this resulted in.

Article 6 negotiations timeline

So, what happened here was that, okay, these three roads to international cooperation were adopted in Paris. Not much happened on Article 6 in COP 22 and COP 23 because countries still needed time to understand what they actually had agreed upon. Some people call this constructive ambiguity. The language is not clear enough to rule out some things and this is perhaps what saved the Article 6 in the end. At COP 24 in Katowice there was an agreement on the Paris Agreement rule book. So the whole enhanced transparency framework and many other things, but parties could not agree on Article 6 at this point. COP 25 in Madrid countries came close to have a text on Article 6.

And what we are talking about here is the operationalization of Article 6, which means the decisions that should come out from that work program I mentioned before. We took until COP 26 in Glasgow before this was adopted. So at COP 26, 2021 the guidance for Article 6.2 were set, the modalities rules and procedures for Article 6.4 and the guidance or the work program for non-market purchase were also set. Some countries think that this is what we need to work with the international carbon market, we don’t need many more things.

But there are details here and some details were agreed upon at COP 27, mainly about a technical review about what countries send in when they’re working (when they’re engaging in Article 6) they have to report on that, and that has to be reviewed. Registry provisions, et cetera. Then last year in Dubai, there was no agreement. There’s hope now to solve these issues this year in at COP 29 in Baku.

Summary

The aim was to show you a bit of the background and the not so easy relation between the Climate Change Convention and carbon markets, and how these 3 different areas under Article 6 emerged.

For the next session in the future we can discuss a little bit more on the development since COP 26 and what countries actually are negotiating now and why they have very different views.