Listen to article

Background

In 2021, the Ministry of National Development Planning of Indonesia stated that financing needed to decarbonize the economy could be up to $200 billion annually until 2030.[1] These figures were released during the pandemic and things may have changed since. However, it still gives a good indication of the sheer magnitude of finance Indonesia needs to mobilize to achieve its nationally determined contribution (NDC) and its net zero emissions target.

One way of attracting foreign investment is through international carbon market(s). In this case, domestic or foreign project developers typically support a project owner to register a project with a carbon crediting standard. This could be via the international compliance market under Article 6 of the Paris Agreement or via the voluntary carbon market(s) (VCM). Registering as a carbon market project would facilitate monetization of emission reductions through the sale of carbon credits.

What are carbon credits?

Cap-and-trade

Emissions trading (cap-and-trade) at the national level typically involves a government-set quantitative limit (cap) on the total allowable level of GHG emissions, which has the advantage of helping a country meet its quantitative emission- reduction target. A cap-and-trade program also enables the price for emissions to be determined by market supply and demand.

Baseline-and-crediting mechanisms

Baseline-and-crediting mechanisms offer an approach for generating tradeable carbon credits that are used to monetize emission reductions achieved. Under baseline-and-credit mechanisms, companies can invest in mitigation actions and demonstrate that the mitigation actions result in fewer emissions than what would most likely have occurred if action had not been taken. When they do so, they are issued with carbon credits. Baseline-and-crediting mechanisms create opportunities to participate in the international carbon market facilitating new international finance flows. The largest and most internationally far-reaching baseline-and-credit mechanism so far is the Clean Development Mechanism (CDM), which was in operation until 2021, now being replaced by the Paris Agreement Crediting Mechanism (PACM, under Article 6.4 of the Paris Agreement). Independent carbon crediting standards such as VERRA VCS, Gold Standard and the ACR are based on the baseline-and-crediting concept.

Understanding the regulatory framework

International compliance market regulation

For the international compliance market (Article 6), the project developer needs to get an authorization from the Government of Indonesia (GoI). This authorization is not about complying with national regulations and protocols, but about GoI ensuring that the carbon credit can be exported and used by an international buyer. This is because under Article 6, both buyers and sellers (in this case Indonesia) cannot simultaneously count the emission reductions towards their targets. This is also why this authorization is not easy to get – GoI needs to be sure exporting those carbon credits will not jeopardize achieving the NDC.

If exporting carbon credits can jeopardize achieving the NDC, what then is in it for Indonesia? Carbon crediting can help GHG emission reduction technologies become economically viable by adding a price of carbon into the equation. Article 6 could also leverage funding for technologies when there are barriers to rolling out specific technologies due to capacity limitations. Low- cost and mature technologies can be seen as the focus of domestic climate mitigation actions, while there is a potential for international markets to invest in less mature and higher- cost technologies. This can increase maturity and decrease costs, enabling these technologies to join those already being implemented by other countries domestically even without international market mechanisms.

Indonesia has made statements in its NDC indicating that international carbon trading under Article 6 of the Paris Agreement is possible, and that the legislative framework is set to allow this under the general rules for the carbon pricing approach in Indonesia. The Presidential Regulation No. 98 of 2021 aims at regulating GHG emissions reductions, enhancing climate resilience, and creating a carbon price to achieve its NDC targets. It opens an opportunity to mobilize climate finance from both international and domestic sources and to incentivize stakeholders’ contributions to NDC achievement.

A Following the 2021 Regulation, GoI has adopted Regulation 21/2022 which clearly states that overseas carbon trading can never occur at the expense of Indonesia realizing its NDC. This implies that the “relevant ministers” (sector ministries) must be able to show that the unconditional targets have already been reached, or being reached with the interventions in place, before the Ministry of Environment and Forestry (MoEF) will authorize international transfer.

The risks of not achieving the NDC have been identified and addressed through different measures in the regulation adopted in October 2022, and the MoEF has clarified the policy in a position paper, reaffirming that Indonesia is open for international carbon trade, but the regulation from 2022 must be complied with. However, how international transfers under Article 6 are to be authorized is not yet fully elaborated. International sovereign buyers as well as the private sector are still looking for more clarity on the process for authorization in Indonesia under Article 6.

VCM regulation

For the voluntary carbon market (when not requiring NDC accounting) things are presumably easier. In the cases where no authorization is required or demanded, the emission reductions can be counted towards the NDC of Indonesia. However, the VCM is still regulated, not by international regulation, but by domestic.

A host country such as Indonesia may decide to require, or not to require, NDC accounting (corresponding adjustments) for carbon market projects aiming for the VCM, but it may also provide an opportunity to make corresponding adjustments if required by the independent carbon programs (ICP) or the seller or buyer, thus not generally requiring NDC accounting of carbon credit transfers to other countries. The one certainty is that if the host country exports carbon credits that are to be used towards another country’s NDC, then NDC accounting (corresponding adjustments) must be made.

Be wary of sectoral regulations

In terms of emission reduction opportunities and in terms of the need for Indonesia to attract international carbon finance, the potential for carbon market projects in Indonesia is large. However, project developers must be aware of sectoral regulations and informed about the options for taking a carbon market project further.

First, as discussed above, getting the authorization in Indonesia may not be straightforward since the respective Ministry needs to clear the export of carbon credits considering NDC achievement process. If this process is not very clear and transparent, an international buyer will hesitate to commit through a commercial agreement with the project developer in Indonesia.

Second, there are also sector regulations that impact the possibility of exporting carbon credits. One regulation has to do with renewable energy and how independent power producers (IPPs) can obtain power purchase agreements (PPAs) with the state-owned power company (PLN). Presidential RegulationNo. 112/2022 provides that the Ministry of Energy and Mineral Resources (MEMR) will issue a guideline for PPAs executed with IPPs. An MEMR implementing regulation has been recently drafted and is being socialized[2]. This implementing regulation sets out the terms of a renewable energy PPA. It also includes provisions on renewable energy attributes and carbon crediting, intermittency of generation, and generation combined with storage.[3] IPPs are awaiting clarity on these matters, which also would be significant for carbon market project developers.

The MEMR has issued Regulation No. 2 of 2024 relating to rooftop solar systems and has clarified that an additional regulation will be issued by MoEF. However, the MEMR has not yet provided any details on the timeline for issuing such regulation nor if, in the interim, the Government would seek to assert its rights over the carbon economic value derived from the use of Rooftop Solar Systems.[4]

More clarity is found for the forestry sector where MOEF has issued Regulation No. 7 of 2023 regarding Procedures for Carbon Trading in the Forestry Sector.

In this context, it is important to note that MoEF has the main responsibility for international carbon markets in Indonesia, but the claims to any carbon assets may require a full understanding of sectoral regulations and provisions.

How to monetize emission reductions

Assume now that you have a project that fits with Indonesia’s policy and is eligible for claiming the right to the carbon asset under sector regulations. The question is now how to monetize the emission reductions. For this, the emission reductions produced by the project need to pass through a verification process under a carbon crediting standard.

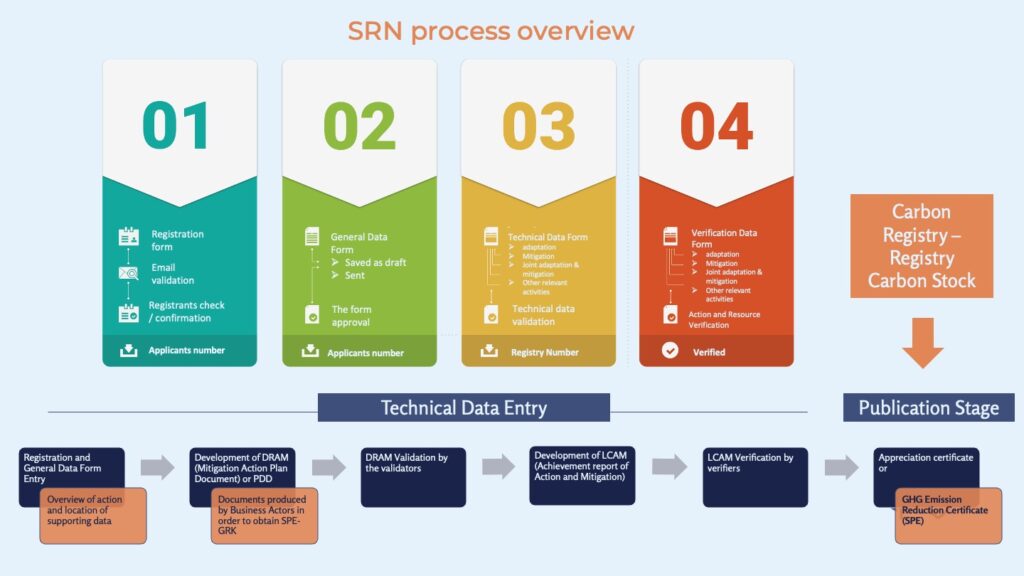

For the compliance market (Article 6) the requirement imposed by GoI is that the emission reduction is issued as a SPE-GRK (Sertifikat Pengurangan Emisi Gas Rumah Kaca), validated and verified by an independent entity accredited by the Komite Akreditasi Nasional (KAN), and registered in the SRN-PPI (Sistem Registri Nasional Pengendalian Perubahan Iklim).

In a case where the project will not result in international export of carbon credits under Article 6 (i.e., involving the transfer of internationally transferred mitigation outcomes, ITMOs), projects can be registered with independent carbon programs (ICPs). In this case, the ICP has its own set of methodologies, validation and verification bodies and registration processes.

Things to look out for is whether there is an approved methodology that can be used, and if the standard, whether it is the national standard in Indonesia (SPE-GRK), an ICP such as VERRA or Gold Standard, or the Paris Agreement Crediting Mechanism, has limitations as to the types of projects it allows.

Conclusions

The Paris Agreement has changed the rules of the game for carbon market projects in developing countries. Since all countries, including Indonesia, have emission reduction targets through their NDCs, export of carbon credits for use by another country or company is not hastily or carelessly permitted. A project developer may first need to decide which route to take – the compliance route under Article 6 or using an ICP for a transfer not involving NDC accounting.

Whether the use is international or domestic, the same process applies. That is, the project developer needs to confirm with the monitoring, verification and reporting requirements of Indonesia so that the project can be registered in the SRN-PPI and the verification process so that emission reductions are issued as SPE-GRKs. Carbon credits from ICPs can be recognized as SPE-GRKs too.

For international transfers, the project developer is encouraged to look at the sector regulations to understand the sector specific conditions and likelihood of obtaining authorization for ITMO transfer. To conclude, monetizing emission reductions will require some effort. However, a transparent regulated national process also provides for a higher price of the carbon credit so it may be worth the effort.

Acknowledgements

Neyen would like to thank the following individuals for their helpful contributions to this article:

- Dr. Riza Suarga, Chairman Indonesia Carbon Trade Association (IDCTA)

- Yani Witjaksono, Executive Director, Yayasan Bina Usaha Lingkungan

Footnotes

[1] A GREEN ECONOMY FOR A NET-ZERO FUTURE: How Indonesia can build back better after COVID-19 with the Low Carbon Development Initiative (LCDI)

[2] This refers to the Indonesian equivalent of public consultation

[3] JETP (2021) Accelerating Just Energy Transition in Indonesia. Public Consultation Draft. November 1 2023

[4] MEMR Regulation No. 2 of 2024 Chapter IV, Other Provisions, Article 40(1) Carbon economic value from using the Rooftop PLTS System carried out in accordance with the provisions of statutory regulations (2) In the event that there are no statutory provisions as intended in paragraph (1), the carbon economic value from the use of the Rooftop PLTS System belongs to the Government.